Affordable insurance for gas engineers – especially tailored for you

Find the Gas Engineer Insurance You Need – The Right Protection at the Right Price

Affordable liability insurance for gas engineers

As a certified gas engineer you know better than anyone the risks that come with the job. Accidents, incidents, even mistakes, can have more serious consequences than in many other contracting sectors – from serious injuries or worse, to big financial losses.

That is why gas engineer insurance is so important. It’s there to make sure you’re covered against accidents and the unexpected. In fact, the right insurance cover could be crucial to protecting you and your business – so leave nothing to chance and let us help you find comprehensive cover, including affordable liability insurance for gas engineers.

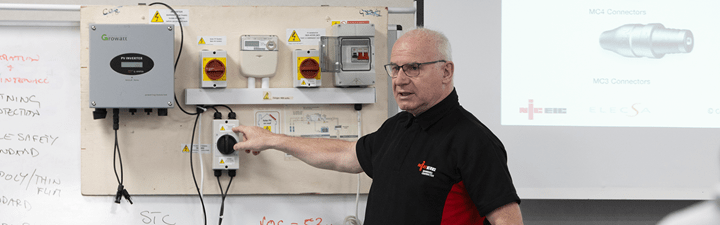

At NICEIC Insurance Services, we draw on our wealth of experience to provide our customers with tailored gas engineer insurance and gas fitter insurance, at a competitive price.

Our gas engineer insurance cover

We know you are busy – and don’t want to be distracted by the task of finding your own insurance. But we also know that finding the right cover is vital to peace of mind so you get on with the job safe in the knowledge that you are protected if something goes wrong.

That is where we can help. Unlike some online insurance providers, we don’t leave you to do all the hard work on your own. We have the sector know-how and the experience to do that work for you.

Simply contact us and we will take the time to understand your needs and approach our specialist and leading UK insurers for you. We’ll ask you some straightforward questions and guide you through the whole process, so you get the cover you need quickly and easily.

And, the best bit...

Registered NICEIC contractors get 10% off the cost of their electrical contractors insurance!

We offer the following:**

-

Cover for contract works.

-

Cover for loss or damage to tools and office equipment.

-

Cover for temporary employees up to 50 days per year.

-

Cover for your own plant and hired in plant.

-

Employers liability cover of £10 million.

-

Free 24 hour business legal helpline.

-

Goods in transit.

The power behind your business

At NICEIC Insurance services, we have the power to protect you from the unexpected, so you can run your business safe in the knowledge that we’ve got you covered.Gas engineers working in most situations can be covered for work in domestic, commercial and industrial premises in Great Britain, the Channel Islands, the Isle of Man, and Northern Ireland. Temporary work in the EU is included as standard too.

What’s more, the core liability covers – gas engineer public liability insurance and employers' liability – can be expanded by adding a range of optional extras, to create tailored protection to suit your individual needs.

Why choose us?

We are part of Marsh Commercial, an award winning*** expert in insurance and risk management providing more than 35,000 business insurance policies for over 21,000 customers across the UK. So it’s safe to say we have the experience and expertise to help you find the tailored cover you’re after, at the right price.Our extensive experience means we are ideally placed to find the gas engineer insurance or gas fitter insurance you need. Our size and scale enables us to offer quotes from a panel of UK insurers – and to negotiate the best possible price and cover we can on your behalf.

That support doesn’t stop once you’ve taken out your cover; it continues throughout our relationship – from changing your policy mid-term to make sure it continues to meet your needs, helping with renewals, to providing an essential, dedicated claims advocacy service you can rely on in the event of a claim.

*1 https://www.niceic-and-elecsa-insurance.com/news-and-information/niceic-and-elecsa-insurance-services-wins-an-exceptional-service-award/

https://www.feefo.com/en-GB/reviews/niceic-and-elecsa-insurance-services?displayFeedbackType=SERVICE&timeFrame=YEAR

*2 As with most insurance – terms, conditions, and exclusions apply. You can request full details by simply contacting us.

*3 marshcommercial.co.uk/about/

Frequently asked questions

Helpful staff over the phone with best price for the level of cover I have requested.

Mr Balazs Balogh