Specialist insurance cover for renewable energy installers – tailor-made protection for electrical contractors.

Protect your business against the unexpected

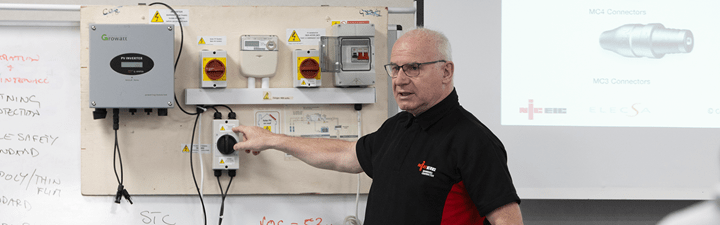

As a renewable energy installer, we understand the risks you face. Unforeseen incidents and accidents can put your livelihood at risk – potentially leaving you out of pocket or unable to carry out your work. You need to protect yourself and your business against these risks with renewable energy installers insurance.

We're committed to protecting you and your business should the unthinkable happen. Working with a leading specialist insurer, we have negotiated high quality insurance at a competitive price for you.

If you become an NICEIC registered electrical contractor, you'll benefit from a 10% discount on the cost of your insurance.

Our renewable energy contractors insurance

By working with a specialist insurer, we've developed insurance with you in mind. It's comprehensive, flexible and affordable.

If you prefer to do things yourself, you can quickly and conveniently get a quote and buy online.

And, the best bit...

Registered NICEIC contractors get 10% off the cost of their electrical contractors insurance! *

We offer the following:**

-

Cover for contract works.

-

Cover for loss or damage to tools and office equipment.

-

Cover for temporary employees up to 50 days per year.

-

Cover for your own plant and hired in plant.

-

Employers liability cover up to £10 million.

-

Free 24 hour business legal helpline.

-

Goods in transit.

-

Public liability cover limits – £1 million, £2 million or £5 million available.

The power behind your business

NICEIC Insurance services is here to help you with all your business insurance needs. From electrical contractors insurance, personal accident and short-term income protection to van insurance and premises insurance – we've got you covered.Unlike many direct insurers or comparison sites, we're here to provide expert advice. We'll explain the finer details of your renewable energy installers insurance cover, so you know exactly what you're protected for. This should give you peace of mind, leaving you to focus on looking after your customers.

Our support doesn't stop there. We're on-hand to guide you through the process of making changes to your cover – mid-term or at renewal, should your circumstances change. But, if you wish to do things yourself, our customer portal puts you in control. Download your documents, make adjustments and renew your policies online.

And, should the worst happen and you need to make a claim, we will help to make sure it's handled as quickly as possible.

Cover is available for renewable installers working on most domestic, commercial, and industrial premises in Great Britain and Northern Ireland, the Isle of Man, and the Channel Islands. In addition, temporary work in the EU is also covered as standard.

*1 https://www.niceic-and-elecsa-insurance.com/news-and-information/niceic-and-elecsa-insurance-services-wins-an-exceptional-service-award/

https://www.feefo.com/en-GB/reviews/niceic-and-elecsa-insurance-services?displayFeedbackType=SERVICE&timeFrame=YEAR

*2 Cover may differ dependent upon insurer. As with most insurance – terms, conditions, and exclusions apply. You can request full details by simply contacting us.

Frequently asked questions

5 star service, highly recommended.

From NICEIC Customer